All Categories

Featured

Table of Contents

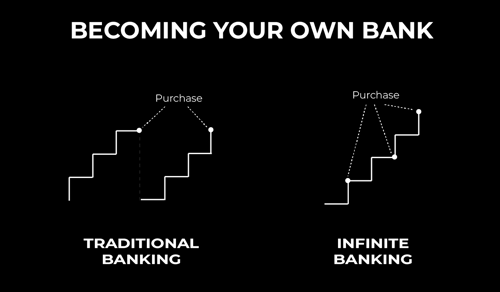

Okay, to be reasonable you're truly "financial with an insurance business" as opposed to "banking on yourself", yet that idea is not as very easy to offer. Why the term "unlimited" banking? The concept is to have your money functioning in numerous areas at the same time, instead of in a solitary place. It's a bit like the idea of getting a residence with cash, then obtaining against your house and putting the cash to work in an additional financial investment.

Some individuals like to talk about the "speed of money", which generally implies the very same point. That does not suggest there is nothing rewarding to this idea once you obtain past the marketing.

The whole life insurance policy market is pestered by excessively costly insurance policy, massive commissions, unethical sales techniques, low rates of return, and inadequately informed clients and salesmen. If you desire to "Financial institution on Yourself", you're going to have to wade right into this industry and really get whole life insurance. There is no alternative.

The guarantees inherent in this item are crucial to its function. You can borrow against many kinds of cash money value life insurance policy, however you shouldn't "bank" with them. As you purchase an entire life insurance policy to "financial institution" with, bear in mind that this is an entirely separate area of your financial strategy from the life insurance policy section.

Get a large fat term life insurance policy plan to do that. As you will certainly see below, your "Infinite Banking" plan truly is not mosting likely to reliably provide this vital monetary feature. An additional issue with the fact that IB/BOY/LEAP relies, at its core, on an entire life plan is that it can make purchasing a plan problematic for a number of those thinking about doing so.

Cipher Bioshock Infinite Bank

Harmful pastimes such as SCUBA diving, rock climbing, skydiving, or flying likewise do not blend well with life insurance policy items. The IB/BOY/LEAP advocates (salespeople?) have a workaround for youbuy the plan on somebody else! That might function out great, considering that the point of the plan is not the death benefit, yet bear in mind that buying a policy on minor kids is more costly than it must be because they are generally underwritten at a "standard" price instead of a preferred one.

Most plans are structured to do one of 2 points. The payment on a whole life insurance policy is 50-110% of the first year's premium. In some cases policies are structured to make best use of the death benefit for the costs paid.

With an IB/BOY/LEAP policy, your goal is not to maximize the death advantage per dollar in premium paid. Your goal is to take full advantage of the money value per dollar in costs paid. The rate of return on the policy is very essential. One of the finest ways to make the most of that element is to get as much cash money as feasible into the policy.

The finest method to boost the rate of return of a policy is to have a reasonably tiny "base plan", and then put more cash money right into it with "paid-up enhancements". As opposed to asking "Just how little can I place in to get a particular death advantage?" the concern ends up being "Exactly how a lot can I lawfully took into the policy?" With more money in the policy, there is even more cash value left after the costs of the survivor benefit are paid.

A fringe benefit of a paid-up addition over a normal costs is that the commission price is reduced (like 3-4% as opposed to 50-110%) on paid-up enhancements than the base plan. The much less you pay in commission, the higher your rate of return. The price of return on your cash value is still going to be negative for some time, like all cash money worth insurance policy policies.

Most insurance firms just provide "direct acknowledgment" lendings. With a direct recognition finance, if you borrow out $50K, the reward price applied to the money worth each year only uses to the $150K left in the policy.

Infinite Banking Concept Scam

With a non-direct acknowledgment financing, the firm still pays the same reward, whether you have actually "borrowed the cash out" (practically versus) the plan or not. Crazy? Who recognizes?

The business do not have a source of magic totally free cash, so what they provide in one area in the plan need to be taken from an additional location. Yet if it is extracted from a function you care less about and take into a function you care much more around, that is a good thing for you.

There is another important function, generally called "wash loans". While it is great to still have actually returns paid on cash you have obtained of the plan, you still have to pay rate of interest on that lending. If the returns rate is 4% and the loan is billing 8%, you're not specifically appearing ahead.

With a clean car loan, your car loan passion price is the exact same as the dividend price on the policy. So while you are paying 5% passion on the funding, that interest is completely offset by the 5% reward on the funding. In that respect, it acts just like you withdrew the cash from a financial institution account.

5%-5% = 0%-0%. Same exact same. Thus, you are currently "financial on yourself." Without all 3 of these factors, this policy merely is not mosting likely to function effectively for IB/BOY/LEAP. The greatest problem with IB/BOY/LEAP is the people pushing it. Almost all of them stand to benefit from you buying into this idea.

As a matter of fact, there are many insurance coverage representatives discussing IB/BOY/LEAP as a function of whole life that are not actually marketing plans with the essential functions to do it! The problem is that those that recognize the concept best have a large dispute of rate of interest and usually inflate the benefits of the principle (and the underlying policy).

Infinite Banking Concept Scam

You should contrast borrowing versus your plan to withdrawing money from your cost savings account. No money in cash money worth life insurance policy. You can place the money in the bank, you can spend it, or you can purchase an IB/BOY/LEAP plan.

You pay taxes on the rate of interest each year. You can conserve some more cash and put it back in the banking account to start to make rate of interest again.

When it comes time to get the watercraft, you market the investment and pay tax obligations on your long term funding gains. You can save some even more cash and purchase some even more financial investments.

The cash money worth not made use of to spend for insurance and commissions expands for many years at the reward price without tax drag. It starts out with unfavorable returns, yet ideally by year 5 or so has actually recovered cost and is growing at the dividend rate. When you go to buy the boat, you borrow against the plan tax-free.

My Own Bank

As you pay it back, the cash you paid back begins growing again at the dividend price. Those all job rather in a similar way and you can contrast the after-tax rates of return.

They run your credit history and provide you a loan. You pay passion on the obtained cash to the financial institution until the financing is paid off.

Latest Posts

Bank Concept

Nelson Nash Life Insurance

'Be Your Own Bank' Mantra More Relevant Than Ever